New rules will accelerate and increase taxation for many individuals who operate as sole traders or as part of a partnership.

Many sole traders and partnerships have financial year ends that do not align with the UK tax year. Tax liabilities for a specific tax year are typically assessed on profit over the twelve-month ‘basis period’ to the year end date that falls in that tax year. Therefore, tax is often due for a specific tax year on profit that was made at least partially in an earlier year. Basis Period Reform is the name given to the changes being implemented to tax unincorporated business only on the profit made in a specific tax year.

At Ryecroft Glenton we are helping our clients with tax forecasting and planning for the effect of Basis Period Reform. This article provides an explanation of the mechanism of Basis Period Reform and details the tax reliefs available. It should be noted that to allow accurate tax projections to be calculated, each business requires a bespoke analysis of their own tax position.

When will the changes occur?

As of the 2024/25 tax year, all affected businesses (sole traders and partnerships with year ends that don’t line up with the UK tax year) must use the tax year as their basis period. They will only be liable for profits arising in that year and subsequent tax years.

The 2023/24 tax year is a transition period, after which time overlap profits or adjustments will no longer exist. This year will see the reporting of profit for the twelve months to a business’ normal accounting date, plus the period to 5 April 2024.

An example of the effect

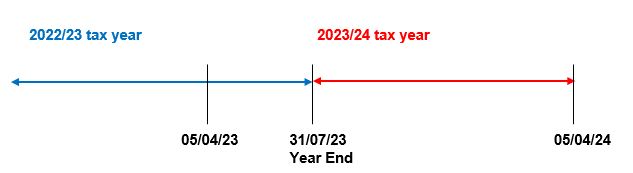

The timeline below illustrates how things were before the new rules and how things will change. We have used the example of an unincorporated business with a 31 July year end.

The blue section shows the ‘old’ basis period:

- Accounts are drawn up for the 12-month period to 31 July 2023.

- The year end date falls in 2023/24 tax year, so the profit to 31 July 2023 is reported on 2023/24 tax returns.

- The tax return for the year to 5 April 2024 is due for filing with HMRC on 31 January 2025 and any balancing tax payment due to HMRC is payable on that date.

The red section shows the ‘new’ basis period:

- The business must report profit to the end of the 2023/24 tax year.

- It is necessary to report the twelve months to the normal year end on 31 July 2023 plus the additional eight months to the end of the tax year.

As you can see, the reporting of the profit for the period from 31 July 2023 to 5 April 2024 has been accelerated by a year.

Anyone who may be affected by the changes described above, but was not previously aware of them, may be feeling a rising sense of panic due to the prospect of a very large tax payment lurking on 31 January 2025. Fortunately, the new legislation includes some scope to mitigate the tax due, as described below.

Overlap profits

The ‘opening years’ rules for sole traders and partners mean that when trading starts the same profit is often taxed in two separate tax years. This ‘overlap profit’ figure is carried forward and can be claimed to reduce taxable profit, typically when trading ceases.

The Basis Period Reform rules mean that the concept of overlap profit will no longer exist and there is scope to offset any carried forward amount in the 2023/24 tax year, to reduce the amount of additional profit being taxed. Either Ryecroft Glenton or HMRC will have a record of each client’s brought forward overlap profit amount.

Transitional relief

Although the full additional profit from the end of the normal accounting period up to the end of the 2023/24 tax year must be calculated, relief provisions allow the taxpayer to pay tax on one-fifth of the additional profit over the course of the five tax years starting with 2023/24.

A taxpayer could choose to tax the transitional profit earlier, rather than spread it over five years. This may be attractive if a taxpayer had very low other income in a specific tax year and could take advantage of a low tax rate.

Change of year end

Businesses who are affected by Basis Period Reform have a decision to make regarding their year end date. Although the new legislation forces a calculation of profit for the tax year period, the business may wish to continue with their normal accounting date for other commercial reasons.

In our experience, the majority of businesses recognise the additional burden of effectively having to account to two dates and are choosing to change their accounts date to align with the tax year.

Summary

We can’t pretend that Basis Period Reform is anything other than a burdensome and challenging issue for most of the businesses and individuals who are affected. It is essential for those affected to have an awareness of Basis Period Reform and the likely effect on future tax payments. Ryecroft Glenton are committed to helping clients fully understand the implications, make the appropriate claims for overlap profit relief and to budget for accelerated tax payments.